All Categories

Featured

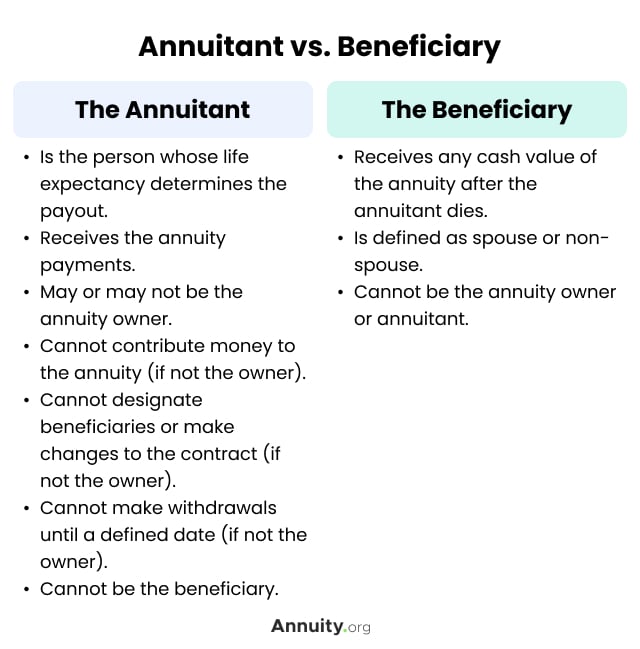

Two individuals acquisition joint annuities, which supply a surefire income stream for the rest of their lives. If an annuitant dies during the circulation duration, the continuing to be funds in the annuity may be passed on to an assigned recipient. The specific options and tax implications will certainly depend on the annuity agreement terms and applicable legislations. When an annuitant passes away, the rate of interest gained on the annuity is managed differently relying on the sort of annuity. In many instances, with a fixed-period or joint-survivor annuity, the passion remains to be paid out to the making it through recipients. A survivor benefit is an attribute that guarantees a payout to the annuitant's beneficiary if they die before the annuity repayments are tired. However, the availability and terms of the survivor benefit may differ depending on the details annuity contract. A sort of annuity that stops all repayments upon the annuitant's death is a life-only annuity. Comprehending the terms of the survivor benefit prior to investing in a variable annuity. Annuities undergo tax obligations upon the annuitant's fatality. The tax therapy depends upon whether the annuity is held in a qualified or non-qualified account. The funds go through income tax obligation in a qualified account, such as a 401(k )or individual retirement account. Inheritance of a nonqualified annuity normally causes taxation just on the gains, not the entire quantity.

If an annuity's assigned beneficiary dies, the end result depends on the particular terms of the annuity agreement. If no such beneficiaries are designated or if they, also

have passed have actually, the annuity's benefits typically advantages usually return annuity owner's proprietor. If a beneficiary is not called for annuity advantages, the annuity proceeds generally go to the annuitant's estate. Fixed annuities.

Tax treatment of inherited Annuity Death Benefits

Whatever part of the annuity's principal was not currently taxed and any type of earnings the annuity built up are taxable as earnings for the beneficiary. If you inherit a non-qualified annuity, you will just owe tax obligations on the incomes of the annuity, not the principal utilized to purchase it. Due to the fact that you're receiving the whole annuity at once, you should pay taxes on the whole annuity in that tax year.

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Right

Exploring the Basics of Retirement Options Key Insights on Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Fixed Annuity Vs Variable Annuity Advantages and Disadvantages of Different Ret

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Vs Variable Annuities Features of Smart Investment Choices Why Fixed Indexed Annu

More

Latest Posts